Can You Take Bonus Depreciation On Buildings . bonus depreciation is a default depreciation provision unless you elect out of it. **percentage deduction:** the bonus depreciation percentage can vary and is subject to change based on tax laws. do i have to take bonus depreciation? new items purchased for a property can be deducted through bonus depreciation, allowing you to deduct the entire cost in a shorter period of time than ever before. Up to 27.5 years for residential buildings and 39 years for nonresidential buildings. If you elect out, you can only elect. buildings can be depreciated over long cost recovery periods: as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction.

from www.educba.com

new items purchased for a property can be deducted through bonus depreciation, allowing you to deduct the entire cost in a shorter period of time than ever before. as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. If you elect out, you can only elect. buildings can be depreciated over long cost recovery periods: Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. **percentage deduction:** the bonus depreciation percentage can vary and is subject to change based on tax laws. do i have to take bonus depreciation? Up to 27.5 years for residential buildings and 39 years for nonresidential buildings. bonus depreciation is a default depreciation provision unless you elect out of it.

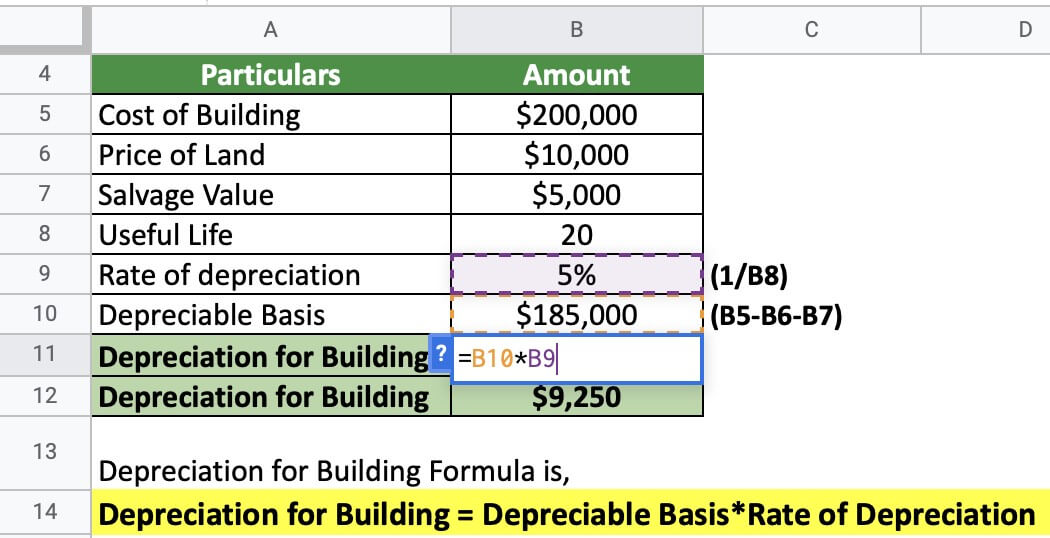

Depreciation for Building Definition, Formula, and Excel Examples

Can You Take Bonus Depreciation On Buildings Up to 27.5 years for residential buildings and 39 years for nonresidential buildings. buildings can be depreciated over long cost recovery periods: new items purchased for a property can be deducted through bonus depreciation, allowing you to deduct the entire cost in a shorter period of time than ever before. If you elect out, you can only elect. bonus depreciation is a default depreciation provision unless you elect out of it. as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. do i have to take bonus depreciation? **percentage deduction:** the bonus depreciation percentage can vary and is subject to change based on tax laws. Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. Up to 27.5 years for residential buildings and 39 years for nonresidential buildings.

From www.thebalancemoney.com

Straight Line Depreciation Method Can You Take Bonus Depreciation On Buildings If you elect out, you can only elect. do i have to take bonus depreciation? bonus depreciation is a default depreciation provision unless you elect out of it. Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. new items purchased for a property can be deducted through bonus depreciation, allowing you to. Can You Take Bonus Depreciation On Buildings.

From www.journalofaccountancy.com

8 ways to calculate depreciation in Excel Journal of Accountancy Can You Take Bonus Depreciation On Buildings bonus depreciation is a default depreciation provision unless you elect out of it. If you elect out, you can only elect. buildings can be depreciated over long cost recovery periods: as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. Appliances, tools, furniture, and other personal property may be. Can You Take Bonus Depreciation On Buildings.

From owlcation.com

Methods of Depreciation Formulas, Problems, and Solutions Owlcation Can You Take Bonus Depreciation On Buildings do i have to take bonus depreciation? Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. buildings can be depreciated over long cost recovery periods: **percentage deduction:** the bonus depreciation percentage can vary and is subject to change based on tax laws. as part of the tcja, there are specific bonus depreciation. Can You Take Bonus Depreciation On Buildings.

From dxofclcyk.blob.core.windows.net

Bonus Depreciation On Farm Buildings at Debra Sprouse blog Can You Take Bonus Depreciation On Buildings as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. buildings can be depreciated over long cost recovery periods: Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. **percentage deduction:** the bonus depreciation percentage can vary and is subject to change based on tax laws.. Can You Take Bonus Depreciation On Buildings.

From rctruckstop.com

Can You Take Bonus Depreciation on a Semi Truck? RCTruckStop Can You Take Bonus Depreciation On Buildings do i have to take bonus depreciation? new items purchased for a property can be deducted through bonus depreciation, allowing you to deduct the entire cost in a shorter period of time than ever before. If you elect out, you can only elect. Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. Up. Can You Take Bonus Depreciation On Buildings.

From dxolyqmlm.blob.core.windows.net

Can You Take Bonus Depreciation On A Building at Nicholas Adams blog Can You Take Bonus Depreciation On Buildings If you elect out, you can only elect. do i have to take bonus depreciation? Up to 27.5 years for residential buildings and 39 years for nonresidential buildings. buildings can be depreciated over long cost recovery periods: Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. bonus depreciation is a default depreciation. Can You Take Bonus Depreciation On Buildings.

From fitsmallbusiness.com

Rental Property Depreciation How It Works, How to Calculate & More Can You Take Bonus Depreciation On Buildings buildings can be depreciated over long cost recovery periods: bonus depreciation is a default depreciation provision unless you elect out of it. do i have to take bonus depreciation? Up to 27.5 years for residential buildings and 39 years for nonresidential buildings. If you elect out, you can only elect. **percentage deduction:** the bonus depreciation percentage can. Can You Take Bonus Depreciation On Buildings.

From dxolyqmlm.blob.core.windows.net

Can You Take Bonus Depreciation On A Building at Nicholas Adams blog Can You Take Bonus Depreciation On Buildings new items purchased for a property can be deducted through bonus depreciation, allowing you to deduct the entire cost in a shorter period of time than ever before. as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. Appliances, tools, furniture, and other personal property may be eligible for this. Can You Take Bonus Depreciation On Buildings.

From www.scoutpropertymanagement.com

Can You Take Bonus Depreciation on Rental Property? Can You Take Bonus Depreciation On Buildings **percentage deduction:** the bonus depreciation percentage can vary and is subject to change based on tax laws. If you elect out, you can only elect. new items purchased for a property can be deducted through bonus depreciation, allowing you to deduct the entire cost in a shorter period of time than ever before. Up to 27.5 years for residential. Can You Take Bonus Depreciation On Buildings.

From www.educba.com

Depreciation for Building Definition, Formula, and Excel Examples Can You Take Bonus Depreciation On Buildings bonus depreciation is a default depreciation provision unless you elect out of it. as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. Up to 27.5 years for residential buildings and 39 years for nonresidential buildings. do i have to take bonus depreciation? **percentage deduction:** the bonus depreciation percentage. Can You Take Bonus Depreciation On Buildings.

From www.blazartax.com

Can you take 100 bonus depreciation? Can You Take Bonus Depreciation On Buildings bonus depreciation is a default depreciation provision unless you elect out of it. **percentage deduction:** the bonus depreciation percentage can vary and is subject to change based on tax laws. do i have to take bonus depreciation? Up to 27.5 years for residential buildings and 39 years for nonresidential buildings. buildings can be depreciated over long cost. Can You Take Bonus Depreciation On Buildings.

From www.uhyhn.co.nz

Can You Claim Depreciation On Your Building? Can You Take Bonus Depreciation On Buildings If you elect out, you can only elect. **percentage deduction:** the bonus depreciation percentage can vary and is subject to change based on tax laws. as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. Up to 27.5 years for residential buildings and 39 years for nonresidential buildings. Appliances, tools, furniture,. Can You Take Bonus Depreciation On Buildings.

From www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium Can You Take Bonus Depreciation On Buildings as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. If you elect out, you can only elect. buildings can be depreciated over long cost recovery periods: new items purchased for a property can be. Can You Take Bonus Depreciation On Buildings.

From www.advancedtaxadvisors.net

How to Qualify for Bonus Depreciation on a Rental Property Advanced Can You Take Bonus Depreciation On Buildings do i have to take bonus depreciation? buildings can be depreciated over long cost recovery periods: **percentage deduction:** the bonus depreciation percentage can vary and is subject to change based on tax laws. as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. new items purchased for a. Can You Take Bonus Depreciation On Buildings.

From investguiding.com

Bonus Depreciation Rules For Rental Property Depreciation (2023) Can You Take Bonus Depreciation On Buildings new items purchased for a property can be deducted through bonus depreciation, allowing you to deduct the entire cost in a shorter period of time than ever before. buildings can be depreciated over long cost recovery periods: as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. Up to. Can You Take Bonus Depreciation On Buildings.

From www.educba.com

Depreciation for Building Definition, Formula, and Excel Examples Can You Take Bonus Depreciation On Buildings Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. If you elect out, you can only elect. new items purchased for a property can be deducted through bonus depreciation, allowing you to deduct the entire cost in a shorter period of time than ever before. Up to 27.5 years for residential buildings and 39. Can You Take Bonus Depreciation On Buildings.

From dxolyqmlm.blob.core.windows.net

Can You Take Bonus Depreciation On A Building at Nicholas Adams blog Can You Take Bonus Depreciation On Buildings as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. Up to 27.5 years for residential buildings and 39 years for nonresidential buildings. If you elect out, you can only elect. do i have to take. Can You Take Bonus Depreciation On Buildings.

From www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium Can You Take Bonus Depreciation On Buildings bonus depreciation is a default depreciation provision unless you elect out of it. as part of the tcja, there are specific bonus depreciation rules relating to farmers that plant particular specified. Appliances, tools, furniture, and other personal property may be eligible for this depreciation deduction. If you elect out, you can only elect. new items purchased for. Can You Take Bonus Depreciation On Buildings.